Hello Everyone-

When the Tax Cuts and Jobs Act (“TCJA”) was passed in December 2017, it become federal law that the maximum amount of state and local taxes (“SALT”) that could be included as a federal itemized deduction on a taxpayer’s personal income tax return (Form 1040), and thereby decrease federal taxable income, was limited to $10,000 regardless of filing status. For many individuals the state income tax withheld plus real estate taxes, greatly exceeded the maximum deduction of $10,000. In essence the federal government was no longer subsidizing high tax states by capping the deduction at $10,000 annually.

Various states have been trying since that time on how to ensure that state and local income taxes could be fully deducted on their federal tax return, trying to identify a way to work around the $10,000 SALT cap. The IRS opened a window for a SALT work around by issuing Notice 2020-75 which allows for an amount paid by a partnership or an S Corporation to a state (or subdivision thereof) to satisfy its income tax liability, to be deductible in computing the entity’s federal taxable income, and that such payments are not taken into account in applying the SALT cap to any partner or shareholder of such an entity.

The New York State legislature and the governor included this SALT workaround in the most recently approved budget that was passed on April 6, 2021. Other states have passed similar legislation. New York has been slow to issue guidance on this workaround, and has only recently done so.

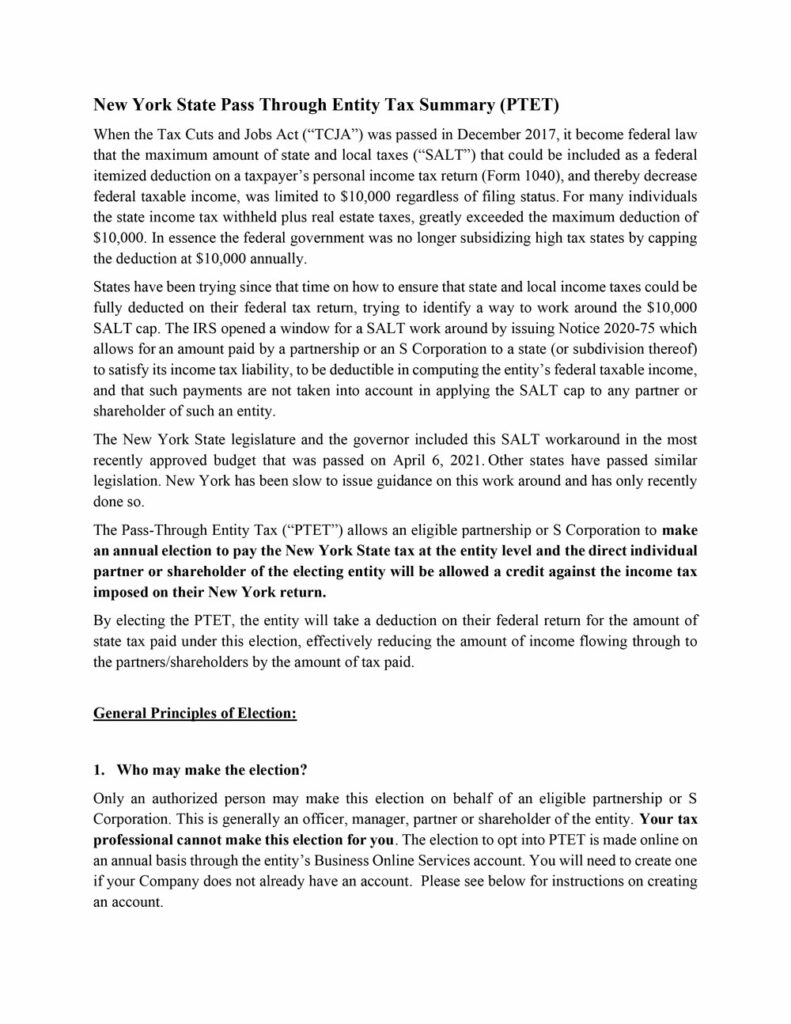

Attached is a summary of the law, who may make the election, and when it needs to be done for 2021 along with other relevant facts.

Please note this is new for 2021 and we expect additional guidance before year end. It could in theory, only be a one year fix if the SALT cap is removed as part of the legislation working its way through Washington. If it’s not addressed, then this would be an annual election.

From a big picture standpoint, if you have an operating entity that generates a substantial amount of New York sourced taxable income, this election would most likely be beneficial. If not, then this election would not be necessary. We have proactively reviewed which clients will most likely benefit and will reach out in the coming days to discuss. This election is due on 10/15 for 2021 so not much time to make a decision for the current year.

As always please contact me with any questions or concerns.

Thank you.

–

View the full New York State Pass Through Entity Tax Summary